Finance often feels like a secret language designed to keep entrepreneurs in the dark. You might be brilliant at running your business, but when an accountant starts throwing around terms like "EBITDA" or "

Gross Margin", well, it’s easy to tune out.

But here's the hard truth: simply casting off the finance job to someone else without understanding the basics is a recipe for disaster. You don't need to be a qualified accountant, but you really do need to understand the scoreboard. If you don't know the difference between "Profit" and "Cash," you are flying blind ... and into potential disaster!

This article is the first of our two-part "Jargon Buster" series. It's here to help: we're stripping away the textbook definitions to give you plain English explanations of the terms that actually matter.

In this section, we focus on the

Profit & Loss (P&L) statement. This is the engine room of your business. It answers the most fundamental question of all:

"Am I actually making any money?"

Think of this as your cheat sheet. Use it to decipher your monthly reports, ask better questions, and maybe even drag that sniffy accountant off their self-erected pedestal.

GENERAL ACCOUNTING CONCEPTS

Accounting Period

The period relating to the management accounts and financial statements prepared.

Management accounts are those used by management to monitor financial performance, and the period can be anything – often annually, quarterly, monthly or sometimes even weekly.

Financial statements are those made to statutory bodies, with the accounting period usually determined by regulation. Major stakeholders (shareholders, volume suppliers and even major customers) may also want to see them. This is usually 12 months, although the start and end dates of the period can vary: the calendar year (January to December) and the financial year (April to March) are the most common.

Tax Point

This is specifically a VAT term in the UK. It's the date that a sales invoice is issued (which may not be the date that cash is received) and determines which "Quarter" the tax falls into.

Accounting Standards

GAAP – stands for Generally Accepted Accounting Principles, a set of accounting standards widely used by companies in the United States

IFRS – stands for International Financial Reporting Standards, a set of accounting standards widely used by companies outside the United States.

Cash Accounting

An accounting method that only recognizes revenue and expenses when they are paid/received.

This is a very simple method used by sole traders and small businesses – especially when payment is delayed or uncertain. But if the business grows, it doesn't give an accurate picture of events, so you must give way to accrual accounting.

Accrual Accounting

An accounting method that recognizes revenues and expenses when they are incurred, regardless of when the cash is received or paid.

This means that if you raise a sales invoice today, its value will be classed as revenue even if you won't be paid some time in the future.

And if you receive a supplier invoice today, its value is recognized as and expense, even if you don't pay it for a while.

This is the most accurate method of accounting, but it requires adjustments in the Balance Sheet for creditors, debtors, and so on (explained in our second article).

Chart of Accounts

A list of all the accounts a company uses to record its transactions.

The company determines it, but an example would be:

• Asset accounts – Things the business owns

• Liability accounts – Debts the business owes

• Equity accounts – Funds put into the business, and drawings by the owner(s)

• Revenue accounts – Money received by the business

• Expense accounts – Money paid by the business

Budget

A document outlining projected income and expenditure over an accounting period.

This is then compared to what actually happens, so that performance can be measured - and changes made if needed.

It's important for any serious business to create a budget, because it doesn't just flag up when things are going wrong, but it can also provide a basis for action if business is going well. Maybe you'd want to increase your marketing for a specific product because there's a new market opportunity.

And, of course, it will enable you to plan spending over the year so it stays under control!

Debit and Credit

Every transaction is recorded in a ledger, whether in an accounting system or an old book kept in the safe.

The ledger transaction always has two sides: Debit and Credit; the value of each must match (or balance).

So a cash sale will create a Sales entry in the Profit & Loss Account, balanced by an opposite Cash entry in the Balance Sheet.

Looking closer, the Sale is entered as a CREDIT in the Profit & Loss Account and the Cash is entered as a DEBIT in the Balance Sheet.

Don't try to understand why an increase in cash is a Debit (sounds wrong, doesn't it?) Just accept that it's how things work.

In other words, in the

Profit & Loss Account, a CREDIT is GOOD, and a DEBIT is BAD.

But in the

Balance Sheet, a CREDIT is BAD, and a DEBIT is GOOD.

PROFIT & LOSS (P&L) STATEMENT

A profit and loss statement (also known as an income and expenditure statement) is an accounting document that shows an organization's profitability (or otherwise).

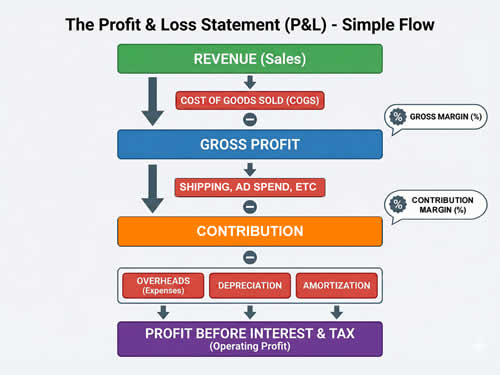

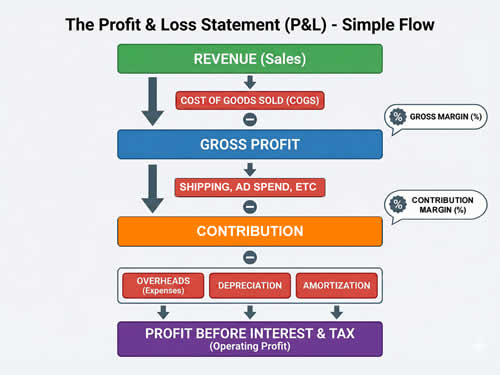

Here’s what it looks like:

So let's break it down.

Revenue (Sales)

This is the income that a company generates from its business activities.

As we say, in the non-accounting (real) world, it's more commonly known as Sales…

Cost of Goods Sold (COGS)

This refers to the direct costs of purchasing or producing goods or services.

Gross Profit

This is calculated by subtracting the cost of goods sold from the revenue.

Example: Your sales total $100,000. The cost of goods is $60,000. Your

Gross Profit is $40,000.

Gross Margin

This is the Gross Profit expressed as a percentage of sales. It shows how efficiently you are producing or buying your goods.

Example: Using the numbers above, $40,000 profit divided by $100,000 revenue equals a 40% Gross Margin.

Contribution

This is also known as Total Contribution. It's the actual cash remaining from sales after deducting all variable costs (COGS, commissions, shipping, and ad spend). This is the money that "contributes" to paying your fixed overheads.

Example: You have spent $10,000 on marketing, so the Contribution is $100,000 (Sales) less $60,000 (COGS) less $10,000 (Marketing) producing a

Contribution of $30,000.

Standard accounts usually lump selling and marketing costs into general "Expenses," but calculating this separately is vital for managers. It tells you if the product itself is generating enough cash to "contribute" towards your fixed overheads (like rent and salaries). This is why accountants use the term "Contribution" which means nothing to most people, but it makes them feel good...

Contribution Margin

This is the Contribution expressed as a percentage of sales. It helps you track if your variable costs are creeping up relative to your prices, and whether your marketing/shipping/etc costs are efficient.

Example: Using the numbers above, your Contribution of $30,000 divided by your Sales of $100,000 produce a 30% Contribution Margin.

Overheads (Expenses)

These are fixed costs like rent and wages costs, that need to be paid regardless of the level of sales, purchasing and marketing, Since they don't directly affect sales, they are often the focus of cost cutting programs ... though over-zealous cutting of staff (a frequent recommendation of accountants with less of a hold on reality) can have devastating consequences...

Depreciation

This is a way of spreading the cost of assets (e.g., computer equipment) spread over time (usually several years).

Take this example. If you buy a $40,000 delivery van, deducting the full cost immediately would make your business look like it made a huge loss that year. Instead, you "depreciate" it by $8,000 a year for 5 years. Your accounts look smoother – and more accurate, in fact.

With computer equipment, this may be three years. With, say, fittings purchased and installed with a new 10-year lease, it may be ten years.

Amortization

This is exactly the same concept as Depreciation, but it is used for

intangible assets—things you cannot touch or kick. Examples are software licenses, patents, trademarks, or "Goodwill" (the value of a business's reputation when you buy it).

Just like the van, you spread the cost of that expensive software license over the 5 years you intend to use it.

MEASURING PERFORMANCE

Operating Profit

This is Revenue minus ALL the

physical costs of doing business (Materials, Wages, Rent, Bills).

It doesn't include Interest, so it tells you whether the business model is actually good at making money!

Example: Let's say your overheads were $20,000, so your operating profit is $100,000 (Sales) less $60,000 (COGS) less $10,000 (Marketing) and $20,000 (Overheads) producing an Operating Profit of $10,000.

Profit Before Tax (PBT)

This is your Operating Profit less

Interest (the cost of any bank loans or debt). This is the figure on which your tax liability will be based (plus or minus any adjustments, which is not a subject for discussion here!)

Example: If you pay $3,000 in loan interest, you'd have a

Profit Before Tax of $7,000.

Net Profit (the "Bottom Line")

This is (at last...) the final result. It is your Profit Before Tax minus

Tax. It tells you how much money is actually left for the owners to keep or reinvest.

Financial Performance Acronyms (EBIT & EBITDA)

These terms sound complex, but they're just ways of stripping out "non-operational" costs to see if the core business is working.

EBIT (Earnings Before Interest and Taxes) This is simply your

Operating Profit. But as we know, accountants love their acronyms.

Using it as a primary measure removes the distortion of tax (which the government controls) and interest (which depends on how much debt you have). It shows purely how good you are at making and selling your product.

PBT/EBT (Profit/Earnings Before Taxes) It's simply what they say - no explanation needed: we're just telling you what the letters stand for, so see above for the definition.

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) This takes EBIT (Or, in plain English, Operating Profit) and "adds back" the Depreciation and Amortization costs.

This is because Depreciation and Amortization are "non-cash" expenses (you aren't writing a cheque for them this month; the cash was spent years ago).

It's a "quick and dirty" (another accountants' term...) way to estimate the

raw cash flow generated by your daily operations. It's actually popular with investors because it makes companies look more profitable than they are on paper.

If you'd like to learn more about accounts and finance, why not take a look at how we can help?

Boost your understanding of accounts with our online courses.

RRP $65 – limited time offer just

$23.99

THE BOTTOM LINE

Well done—you’ve made it through the engine room without getting your hands too dirty. Hopefully, terms like "EBITDA" and "Contribution Margin" now look less like secret codes and more like the useful tools they are.

You now have the power to look at a set of accounts and answer the big question:

"Is my business model actually working?"

But—and this is a huge "but" -

Profit is not the same as Cash.

As we saw with Accrual Accounting, you can look like a millionaire on your P&L while having zero pounds in the bank to pay the electric bill. A profitable business can still go bust if it runs out of fuel.

That's where Part 2 comes in.

So in the next article, we leave the theory of "Profit" behind and look at the hard reality of "Survival." We'll decode the Balance Sheet, explain why "Cash is King," and help you understand how strong your business actually is.

So, take a breather, let these definitions sink in, and click through to Part 2: The

Balance Sheet & Cash Flow Jargon Buster.

Would you like a copy?

We hope you find it useful!